News

How to Write a Winning Chargeback Rebuttal Letter

Knowing how to write a proper rebuttal letter is an essential part of chargeback representment. As with much of the chargeback management process, it can be difficult to know what the expectations and requirements are from the banks and card brands with regards to representments and chargeback rebuttal letters. This article will help you understand what a rebuttal letter is, how it should be formatted, and what it needs to contain. We will also provide an example of a chargeback rebuttal letter.

Lord Byron wrote, “Letter writing is the only device combining solitude with good company.” Of course, he almost certainly was not pondering chargeback rebuttal letters when he wrote that.

What Is the Purpose of a Chargeback Rebuttal Letter?

If chargeback representment could be compared to a job application, the compelling evidence might be akin to a resume while the rebuttal letter functions like a cover letter. The ultimate success of your chargeback dispute will depend on how well your evidence rebuts the cardholder’s chargeback claims. However, the person assigned to adjudicate your chargeback dispute will likely begin by reading your chargeback rebuttal letter.

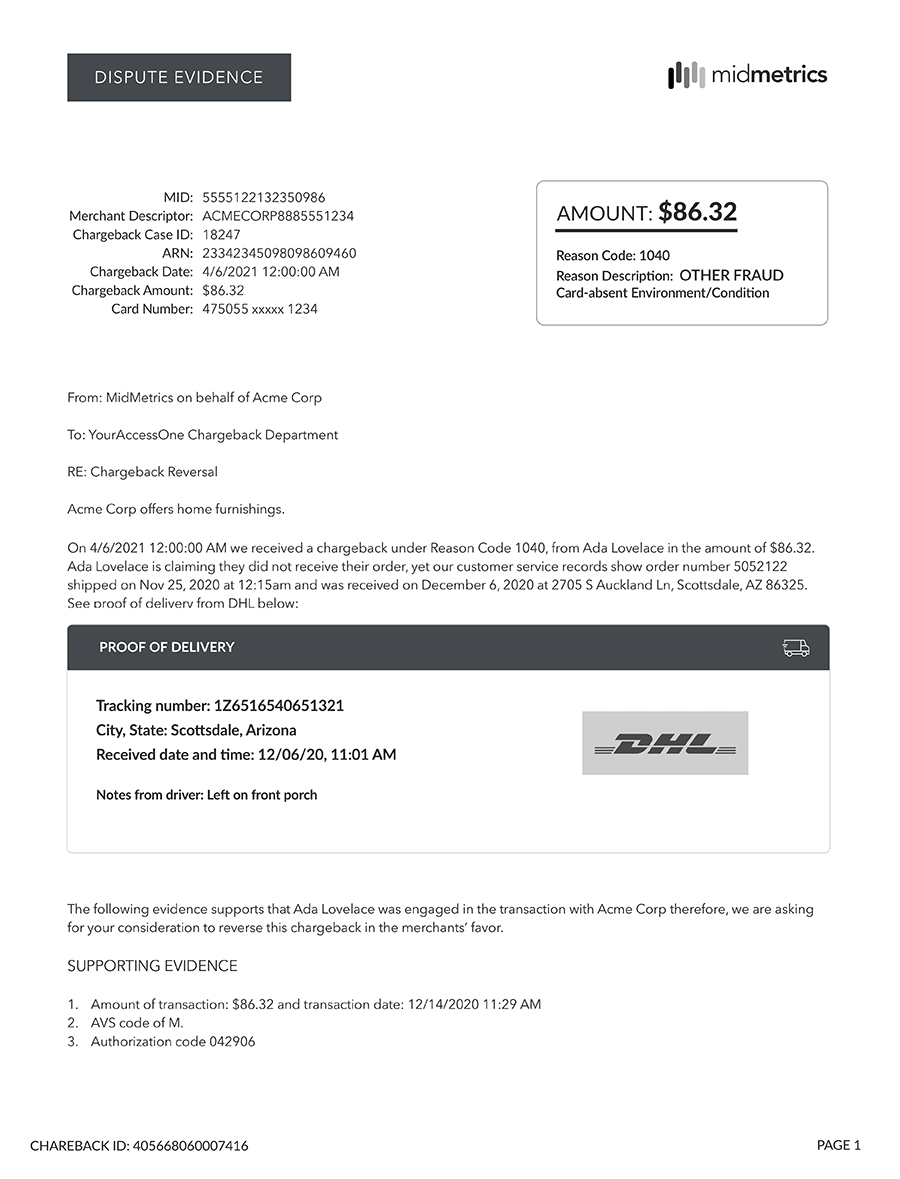

An effective chargeback rebuttal letter should concisely frame your response to the chargeback. It provides any necessary information to identify the transaction, addresses the specific claims that the cardholder had presented, and outlines what supporting evidence will be provided. It also explains what outcome you are seeking. It is the tip of the spear of chargeback representment.

What Is the Format of a Chargeback Rebuttal Letter?

A chargeback rebuttal letter is, in fact, a letter. It should be formatted as a letter, with designations showing who it is from and to whom it is addressed, as well as a subject heading. It should be no longer than one page and it should contain all identifying information for the chargeback dispute. A chargeback rebuttal letter should include the correct information and be formatted such that it is legible to the acquiring bank, issuing bank, and card brand.

What Information Should Be Included in a Chargeback Rebuttal Letter?

While each letter will vary slightly according to the specifics of the chargeback and the requirements of the banks and card brand, any chargeback rebuttal letter is going to contain some of the following:

- The reason code for the chargeback

- The transaction amount, chargeback amount, and amount you are disputing (these may not all be the same amount, depending on circumstances)

- The adjustment date

- Your business’s name

- Your Merchant ID Number (MID)

- The case number for the chargeback

- The payment card number

- The cardholder’s name

- The deadline for completing your representment

- A summary of any actions already taken by the merchant or acquirer

- The acquirer reference number (ARN)

- Any other case numbers or identification codes

- A summary of the compelling evidence to be presented and how it supports your claims

Chargeback Rebuttal Letter Sample

Here is an example of a chargeback rebuttal letter. Please note that this sample does not capture the full range of possible merchant rebuttal formats but is simply a broadly representative example of how a letter might appear.

Conclusion

Managing chargebacks is a difficult but essential effort for any merchant, with the representment process being among the most confounding aspects. Knowing when to dispute a chargeback, how to craft a rebuttal letter, how to complete a Chargeback Adjustment Reversal Request, and how to present the right compelling evidence—all tailored to the specific policies and requirements of the different banks and card brands—can be an overwhelming task for merchants who would rather focus on actually running their business. MidMetrics has a new solution to these challenges.

DisputeGenius™ is an intelligent chargeback representment platform that streamlines chargeback disputes. With just a few clicks, merchants can now accept or dispute chargebacks with our dynamic, intelligent, dispute wizard, which accounts for types of chargeback reason codes, business verticals, data, transactional data and shipping and utilization methods, etc. And, should you need to dispute a chargeback, DisputeGenius™ can write a chargeback rebuttal letter for you. All you need to do is provide the requisite details into our easy-to-use and customizable templates and DisputeGenius™ crafts a winning chargeback rebuttal letter. Save time, recover lost revenue, and simplify your representments with DisputeGenius™.

Get a FREE demonstration of DisputeGenius™ today

Frequently Asked Questions

Chargeback rebuttal letters can be written from scratch by the merchant, written based on templates available online, written by outsourced chargeback management solution providers, or created through the use of a dynamic chargeback representment tool.

A chargeback rebuttal letter is the introduction to and summary of a chargeback representment response.

Compelling evidence is something that a merchant must provide in order to dispute a chargeback. It can include documents such as written communications with a customer, delivery confirmations, biometric payment confirmation information, and other written evidence that the merchant fulfilled their contract with the customer.

It is certainly possible to use a chargeback rebuttal letter template to write a rebuttal letter. But it could ultimately prove more time-consuming and less effective than other methods. If you have the knowledge, experience, and available time to write your own letter, that is likely to be more effective than a template-based letter. Alternatively, if you do not have the time and experience, outsourcing your rebuttal letter creation is another option—albeit one that requires a degree of faith in the chargeback company that you hire. Another possibility is to use a tool that helps you write rebuttal letters through the use of dynamically generated templates, offering a balance of effectiveness, ease of use, and in-house control.